FOR FINANCIAL INSTITUTIONS

The complete solution for transparent and scalable cannabis banking

Green Check Verified works completely within the existing financial system, not around it. In doing so, we enable banks and credit unions to develop an end-to-end cannabis program built on a foundation of efficiency, transparency and scalability for long-term success.

OUR CUSTOMERS

Trusted by the best in the business

Why Green Check

Green Check works with more financial institutions than any other provider in the cannabis banking space. The reason is simple: We offer the best-in-class software, data insights, and services needed to build and scale leading cannabis banking programs, not projects. Our software automates the most time-consuming, error-prone aspects of cannabis banking compliance with the unparalleled accuracy examiners expect. Combined with our expert advisory services, which cover you from initial evaluation all the way through to customer acquisition, we are a full-service partner to financial institutions seeking a highly successful cannabis line of business.

GREEN CHECK AT YOUR SERVICE

Program Readiness Engagement

Our team of subject matter experts guide you through every step needed to make your institution cannabis banking ready. Using proprietary data and tools, along with vast experience building and scaling successful programs, we ensure that your intuition kicks off this line of business with the tools, information, insights and program roadmap needed to succeed in cannabis banking.

COMPREHENSIVE PACKAGE INCLUDES:

Risk Assessment Workshop & Tool

Green Check’s compliance experts work with your institution to evaluate your existing control environment, assess your FI’s cannabis-specific risks and needed controls, and deliver custom guidance and documentation to set you up for program success.

Financial Model Workshop & Tool

Leverage our industry knowledge to determine the market opportunity and financial impact of your program. Develop a customized model based on your priorities while determining what products, services and pricing you want to offer. Finally, forecast and track the performance of your cannabis banking program.

Policies and Procedures

You gain access to our full resource library of program documentation, and our team works in tandem with your institution to update your program documentation in preparation for a successful, compliant launch.

Go-To-Market Strategy

Green Check helps you define your institution’s product and service offerings based on industry benchmarks and market opportunities. This includes helping you implement the operational processes that best fit your institution. Additionally, we supply you with key success metrics and milestones and help you define your communications strategy to the market.

Board & Employee Training

Green Check’s compliance experts will develop a bespoke curriculum for your board of directors, as well as the employees involved in building the cannabis banking program. Training facilitates a true understanding of the legal cannabis industry, as well as the specific regulatory and operational factors relevant to your program.

Co-Developed Board/Examiner Presentation

Green Check helps you compile — and if requested present — a comprehensive board/examiner presentation incorporating workshop deliverables, tools and resources.

Our Complete Solution

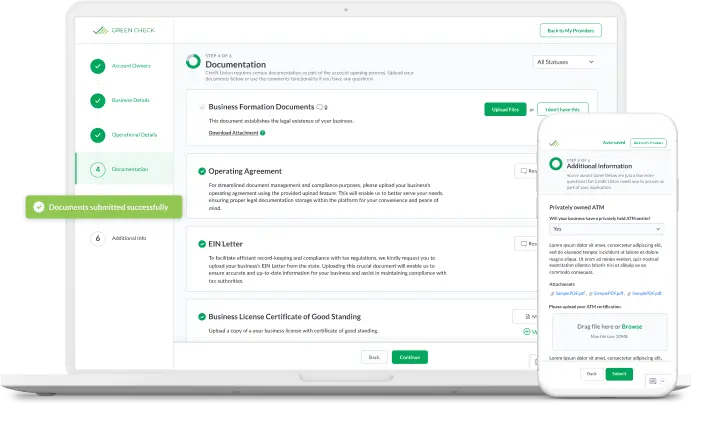

Due Diligence

Green Check makes it easy to launch or scale your cannabis program by helping you partner with businesses that best match your program’s goals.

Our onboarding feature lets you standardize your enhanced due diligence process and automate documentation upkeep and maintenance — allowing you more time to focus on building relationships.

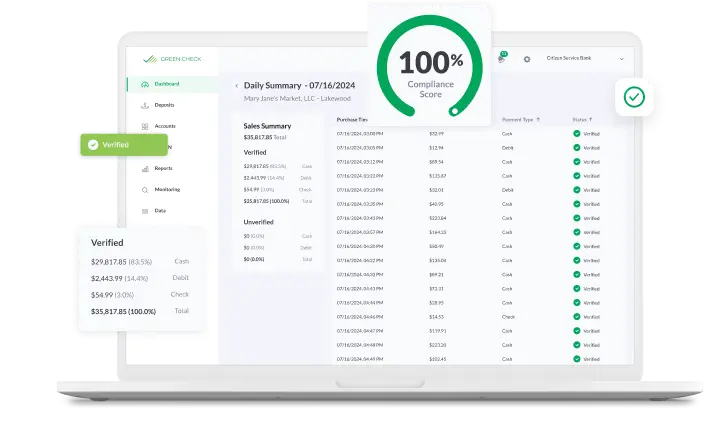

Compliance Rules Engine

Green Check’s Compliance Rules Engine analyzes in real time the sales and inventory data flowing through each cannabis business in your portfolio and identifies any exceptions to the applicable regulatory requirements for their license type.

As a result, you’re able to prevent any non-compliant funds from entering your institution while maintaining visibility into your customer’s corrective actions.

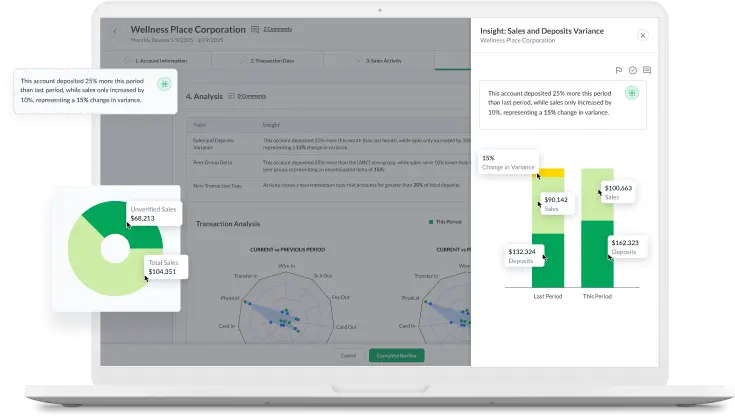

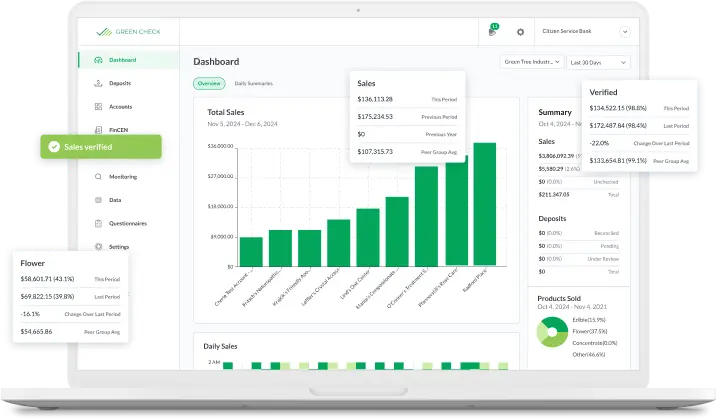

Account Monitoring

A strong cannabis program employs the necessary account oversight activities to surface anomalies and identify trends, both for a single account and across your portfolio.

Green Check’s standardized review process helps you reduce the time and effort required to perform oversight while giving you unparalleled visibility into each cannabis business’s activity.

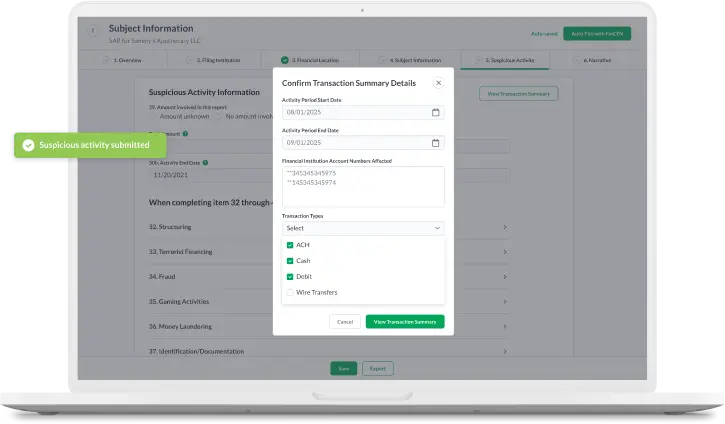

FinCEN Reporting

One of the most common challenges for banking the legal cannabis industry is the additional overhead of more FinCEN reporting requirements. These reports tend to be time-consuming and cumbersome, thus introducing the risk of reports being omitted or filed incorrectly.

The standardization and automation features of the Green Check platform help to reduce the time, cost and risk associated with your FinCEN reporting requirements.

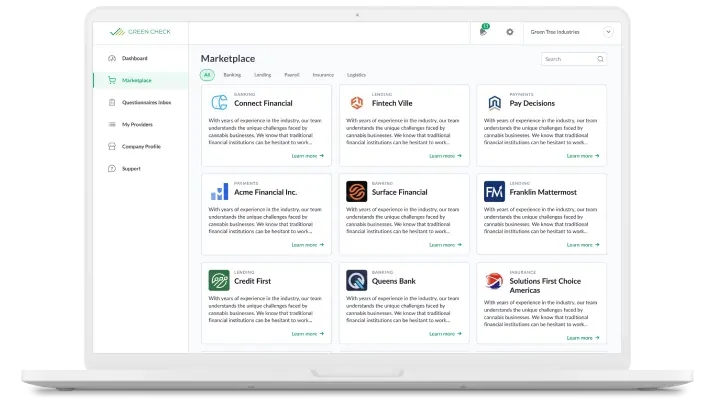

Marketplace

The Green Check Connect marketplace leverages an intelligent match capability for prospects that fit your ideal customer profile while allowing your existing customers to find new, non-competitive business services. This new feature is optional and free-to-use for all Green Check Verified clients.

HEAR FROM YOUR PEERS

Customer success stories

GREEN CHECK ACCESS

Real-time cannabis data API suite

Green Check’s API platform — Access — provides developers with the ability to create bespoke financial and business solutions for the cannabis industry by unlocking access to cannabis compliance, company and transactional data.

Green Check Treasury

Offer embedded financial solutions within your core application using Green Check’s banking-as-a-service APIs

Green Check Payments

Access a safe and comprehensive payment ecosystem that was purpose-built to serve the cannabis industry

Green Check Trace

A single API to connect to all state track-and-trace systems to increase compliance and reduce time to market.

Green Check Verify

Search and verify license and ownership information with direct access to regulatory documentation for tens of thousands of businesses.

Green Check Insights

A library of benchmarks, KPIs, and time-series data powered by the wealth of anonymized transaction data within the Green Check ecosystem.